To guarantee its competitive edge in the face of so many business opportunities in the country, Triunfo constantly invests in its operational excellence. By taking this attitude it displays to the market its capacity to competently manage long-term infrastructure projects.

At present Brazil´s logistical structure is, simultaneously, a major challenge and a primary vector for the country´s development. The present scenario provides great opportunities for businesses in the infrastructure sector, seeing as there is such massive demand for solutions and improvements which facilitate the efficient outflow of Brazilian industrial and agricultural products.

To accompany this scenario and overcome these challenges, Triunfo´s businesses have a well-structured process of operational planning and management. The company continuously invests in the monitoring of risks to identify and minimize exposure to vulnerabilities inherent in the activities associated with the diverse sectors in which it acts.

To work in such highly promising sectors, which propel the development of the country but which also expose the company to high risk and require high financial inputs, constitutes a major challenge. This is why Triunfo possesses its New Business Directorship. The department conducts a rigorous process of evaluation of the potential of every opportunity in the infrastructure sector and strategically develops the most intelligent business solutions.

To work in such highly promising sectors, which propel the development of the country but which also expose the company to high risk and require high financial inputs, constitutes a major challenge. This is why Triunfo possesses its New Business Directorship. The department conducts a rigorous process of evaluation of the potential of every opportunity in the infrastructure sector and strategically develops the most intelligent business solutions.

The energy sector offers a very positive scenario for the years to come. To ensure the success of predicted energy auctions in 2013, the energy sector and the federal government have negotiated the revision of rates of return for investments in the sector.

In accordance with the Ten-Year Energy Expansion Plan 2020, the installed capacity of the Brazilian electrical energy generating complex should grow by 56% over the next decade, representing an increase of approximately six thousand megawatt hours per year. The National Interconnected System (SIN), responsible for the distribution of all this energy, should grow by 43% and reach 142,000 km of transmission lines. To illustrate this positive diagnostic, it is worth citing the predicted R$148 billion in electrical energy project contracts, of which R$ 120 billion is directed to the area of generation.

What is more, this promising scenario for hydroelectric energy production and wind (Eolic) power generation is likely to accelerate still further over the next few years. In 2011, there was a 6.2% increase in hydroelectric production and Eolic generation grew by 24.3%. On the other hand, production of electricity from biomass (generated from sugarcane) saw a reduction according to the National Energy Balance 2012.

Even when reduced to 44.1%, the proportion of renewable energy in the Brazilian energy matrix is well above the global average of 13.3%, according to the International Energy Agency.

The energy sector also has its share of risks, principally those connected to weather and climatic events. Long periods without rain can require energy rationing measures. This is what happened in Brasil between 2001 and 2002, when an energy crisis was triggered after several years of severe drought. But damage such as this can be minimized. An efficient plan of risk management, carried out by Rio Verde, ensured its continued energy production in 2012, despite facing an extended period of drought.

In the electricity sector, risk is concentrated around energy demand, which directly influences regular cash flow.

The energy sale agreement with Votener is subject to annual adjustments. The current tariff of R$188.00 per MWh refers to the most recent adjustment, which occurred in May 2012. The average tariff (R$/MWh) presented also takes into account the sale of surplus energy and reimbursement of tariffs for usage of the transmission network (TUST). Rio Verde presented growth in gross revenue from energy generation of 13.3% on the previous year.

During the year, there was only one recorded interruption in the production of energy, of less than one hour, due to the pre-programed inspections of two machines. This excellent result is thanks to the preventative maintenance carried out on the equipment. Inspections are carried out after every ten thousand hours in operation. GRI EU28; EU29

One of Triunfo´s goals is to contribute to the logistical modernization of Brazil, by offering solutions which help to reduce bottlenecks.

To make up part of the country´s logistical demands, the government foresees the bidding for concessions to operate 10,000km of highways over the coming years. According to the Ministry of Transport, the investment in this scheme is estimated at R$42.6 billion. In 2013, 7,500 km of highway are to be conceded and, over the next five years, the duplication of 5,700 km of highways is expected.

The process of bidding for concessions of Brazilian highways has shown various positive results. The expansion in the number of highways managed by private concessions has meant a major leap forward in the quality of management of these roads. As well as lightening the burden on the public sector, investment in modernization and continuous road maintenance guarantees improved safety for road users, incentivizing more frequent use.

To keep up this process of modernization, the Federal Government realizes that it is necessary to incentivize concessionaires and offer better cost conditions. In 2012, of the 219,000 km of paved roads in the country, 7.4% were administered by 55 concessionaires, representing 15,400 km.

The modernization of roads is recognized by the road users. According to the National Transport Confederation (CNT), the most recent surveys revealed that 86.7% of the population considers the highways under concession to be good or excellent, while the public highways achieved an approval rating of only 27.8%. In 2012, total traffic on toll roads was 1.6 million vehicles, according to the Brazilian Association of Highway Concessionaires (ABCR). These vehicles circulate on 4,700 km of Federal highways, 10,600 km of state highways and 17,400 km of municipal highways.

In the cargo sector, highways account for 61.1% of the total cargo transported in 2012, according to the CNT. Railways correspond to 20.7% and waterways were responsible for 13.6% of cargo transported.

For 2013, the National Land Transport Agency (ANTT) also announced new concessions, which include the highways: BR-262 (MG-ES); BR-040 (DF-MG); BR-050 (GO-MG); BR-060, BR-262 and BR-153 (DF-GO-MG); BR-153 (TO-GO); BR-101 (BA); BR-163 (MT); and BR-163, BR-267 and BR-262 (MS). The concessionary package consists of infrastructure operations with the provision of public services of recovery, conservation, maintenance, operation, implantation of improvements and increasing of capacity along the stretch. The real rate of return for the project is 7.2%.

Concepa received the greatest concentration of traffic of Triunfo´s three highways. In 2012, there was an 8.1% increase in vehicle circulation, compared to the previous year. The volume of cars increased from 32,901 to 35,555 during this period. The effective average fare increased from R$5.20 to R$5.60, an increase of 7.1%. The highway showed overall growth of 7.5% in 2012.

The highway shows a seasonal flux in traffic, the volume increases significantly during the summer season, when it reaches an average of 60,000 vehicles per day. This heavy flow is 80 vehicles per minute, reaching 100% of the road capacity.

So as to alert drivers, Concepa spreads information via the media with travel alerts advising the best times to travel, and also via signs along the highway, on the website and via social media. As well as providing a service to the public, so drivers face less congestion, these preventative actions also help the company to reduce greenhouse gas emissions by half. Today, level of satisfaction amongst Concepa´s highway users is 84%. GRI PR5

As a safety measure, access to the highway for the circulation of pedestrians is blocked. The highway administered by Concepa is a controlled-access freeway and one of the safest in the country, with three lanes of 3.75 meters in width (wider than the average of 3-3.5m for Brazilian toll roads). In the case of accidents, this extra width allows a safety margin with more space for vehicles to avoid the accident site.GRI PR5

CONCER

In 2012, the highway administered by Concer saw a circulation of 31,241 vehicles, a volume 6.0% higher than in 2011, and the average effective fare increased from R$7.40 to R$7.60. The highway´s showed growth of 5.6% over this period.

The concessionaire is constantly investing in improvement works and already began the implementation of the Nova Subida da Serra Project of the BR-040, after receiving authorization from the National Land Transport Agency (ANTT). The project will duplicate 15 kilometers of a mountainous stretch of the road and construct a tunnel of approximately five kilometers, totaling 20 kilometers of new road. The works represent a major investment in the Brazilian transport infrastructure, seeing as the BR-040 operates as an important corridor for economic development of the country.

ECONORTE

The highway Econorte, which connects the state of Paraná to São Paulo, had a circulation of 15,200 vehicles in 2012, a traffic volume 4.3% higher than in 2011. The effective average fare increased from R$9.80 to R$10.20, an increase of 4.4%. During the same period, the highway showed growth of 5.4%.

Econorte uses a System of Environmental Management, responsible for the monitoring of natural resource use and management of waste and polluting gases. With the objective of preserving the environment, waste which cannot be reused or recycled is forwarded to the Highways Department (DER) and resurfacing work along the highway uses polymer-improved asphalt. GRI EU26

Econorte possesses the environmental certification ISO 14001, achieved in 2011, and next year will establish environmental targets that will provide gradual improvements in emissions reductions, energy and water consumption reductions and improved reutilization of waste products. Another important action was the change of fuel use within the vehicle fleet, which now uses biodiesel and ethanol.

Brazilian shipping companies have spare capacity available for more goods on their ships, have credibility in the market and guarantee a weekly schedule on their routes. However, for cabotage to become more profitable and attractive, it is extremely necessary to reduce operational costs in relation to other modes of transport. According to the Brazilian Cabotage Services Association (ABAC), 65% of cargo in the country is transported by truck, while only 17% is transported by cabotage. The government´s goal is to expand this mode of cargo transport to reach a target of 30% by 2025. To achieve this it is necessary to attract new clients, principally small and medium-sized businesses.

According to the National Waterways Transportation Agency (ANTAQ), the general cargo stored in containers grew by 25% in 2012, which represents 5.1% of the total transported. Liquid bulk goods were the most transported (79% of total), followed by loose bulk goods (12.3%) and loose general cargo (3.5%).

In 2012, Maestra Logística carried out weekly routes between Brazil´s main ports, transporting 40,810 TEUs. Over this period, average effective tariffs fell from R$3,900 to R$3,170 per TEU. The net operating revenue of the company showed positive results and expectations are even more positive for 2013, considering that increasing diesel prices will have an impact on the cost matrix of the highway transport sector, favoring cabotage as an alternative.

In relation to safety and security, the company showed very positive results in 2012. The rate of accidents was practically zero, with only one incident involving third-party freight. This result reaffirms the high level of security provided by ship transport, due to the fact that theft of cargo is almost non-existent.

The cabotage mode of cargo transport is not only attractive economically and for its security. Cabotage is also far more efficient as regards the question of emissions per kilometer transported. While transport emissions for cabotage reach only 13.5g of CO2/km, railway transport emits 39.6g of CO2/km and road transport 57.1g CO2/km.

So as to minimize still further the environmental impact of its activities, Maestra is looking into the use of wooden floors made from bamboo from reforestation projects in its future containers and renovating its fleet with ships equipped with more efficient motors, with lower fuel and energy consumption demands.

The ports sector is responsible for the overwhelming majority of Brazil´s exports, with one of the lowest cargo transport costs. According to ANTAQ, the sector handled 900 million metric tons in 2012. Of this total, 332 million tons was iron ore (36.7%), 195 million tons was fuels and mineral oils (crude oil) (21.5%), and 87 million tons was containers (9,6%), making up 68% of the total exported. There are 34 public ports, both maritime and fluvial, as well as 42 private use terminals and three port complexes under concession to private enterprises. The predicted investment in the sector, in the coming years is R$7.5 billion.

Portonaus was created after identification of a business opportunity in the Northern region of Brazil, which currently displays a saturated port infrastructure making cabotage operations unviable. With this new undertaking, Triunfo hopes to open up new navigation routes, both for cabotage and for exportation and importation. It foresees investments in the acquisition of equipment, construction of quays and an expansion of the storage and yard area.

Portonave

In 2012, the company received 594 ships, amounting to the handling of 620,000 TEUs of cargo, a volume 13.7% higher than in 2011. Of this total, exports made up 52.2%. Portonave integrates the port complex of the River Itajaí-Açu, the second largest in terms of handling of containers in the country. The terminal contains a cold-storage facility, administered by Iceport, with a static storage capacity of 16,000 tons.

The aviation sector in Brazil is highly promising. According to Infraero, the country has 142,000 km of airways, moving approximately 100 million passengers, through 66 airports. To provide for this growing demand, the sector recently began holding auctions for airport concessions. In 2012 there were auctions held for the airports of Guarulhos, Viracopos and Brasília. In 2013, the government is expected to hold auctions for the concessions of Galeão (RJ) and Confins (MG) airports.

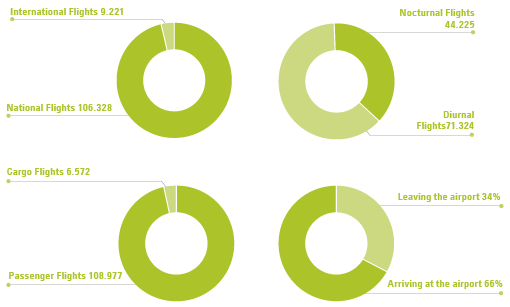

Investment in the Viracopos International Airport is expected to be R$9.5 billion. The first phase runs until May 2014, with inputs of R$2.06 billion, an amount which covers the construction of a new terminal, with capacity to receive 14 million passengers per year. In relation to cargo transport, the concessionaire Aeroportos Brasil Viracopos received 163,000 tons and boarded 84,000 tons, totaling a circulation volume of 248,053 tons through the terminal. GRI AO3Brazil Viracopos Airports

With predicted investment of R$11.5 billion, Vetria is founded on a partnership between three companies: América Latina Logística, which owns the concession for the railway between Corumbá and Santos (50.4% of capital); Vetorial Participações, owner of iron ore deposits in Corumbá (33.8%); and Triunfo, owner of the land where the port terminal will be installed in Santos (15.8%). There will be investment of R$6.4 billion for adaptation of the existing train line, which will facilitate the logistics of transporting the ore. The modernization of the mine in Corumbá will receive R$2.3 billion, directed towards the extraction, crushing and sorting of the product. To complete these actions, there will be a new port terminal constructed in Santos, with capacity to receive ships of 120,000 ton cargo capacity. R$2.8 billion will be invested in constructing the port.VETRIA

Brazil is considered one of the main global players in the mining sector. The segment is a key aspect in the economic development of the country. Aware of its importance, the Brazilian Government, through the Ministry of Mining and Energy, elaborated the National Mining Plan 2030, which constitutes a strategic tool to guide policies which contribute to the mining sector as a foundation for the country´s sustainable development.

To make this possible, the Plan promotes the alignment of the sector with national directives for long-term development, such as raising employment and income levels, and maintaining consistent, steady growth of GDP. The Plan also conceives of a vision of a desirable future for the Brazilian mining sector over the next 20 years, unfolding through eleven strategic objectives grounded in three principle directives: public governance, value addition and sustainability.

© 2024 Relatório de Sustentabilidade Triunfo